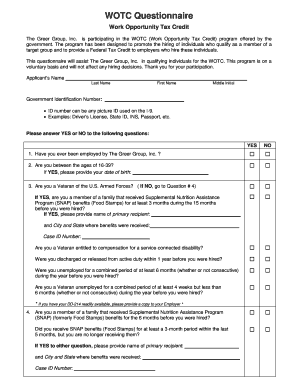

work opportunity tax credit questionnaire on job application

Each year across the United States employers claim more than 1 billion in tax credits under the WOTC program. WOTC reduces an employers cost of doing business by decreasing their federal.

Work Opportunity Tax Credits Wotc Walton

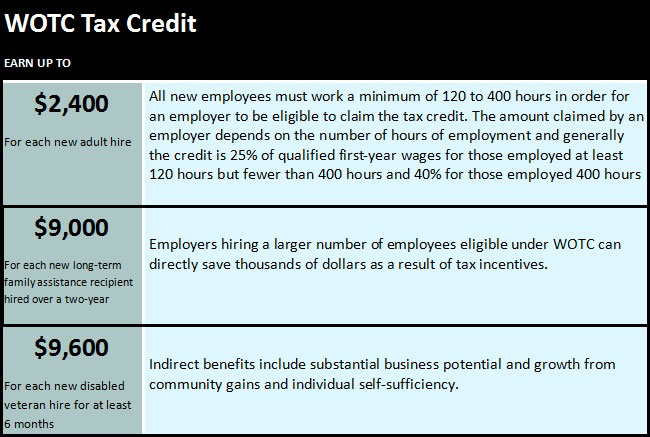

This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training.

. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. While they cant say ONLY certain demographics may apply they target tax-advantagous audiences. WOTC Improve Your Chances of Being Hired.

The Work Opportunity Tax Credit is a voluntary program. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire.

Employers can still hire these individuals if they so choose but will not be able to claim the tax credit. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

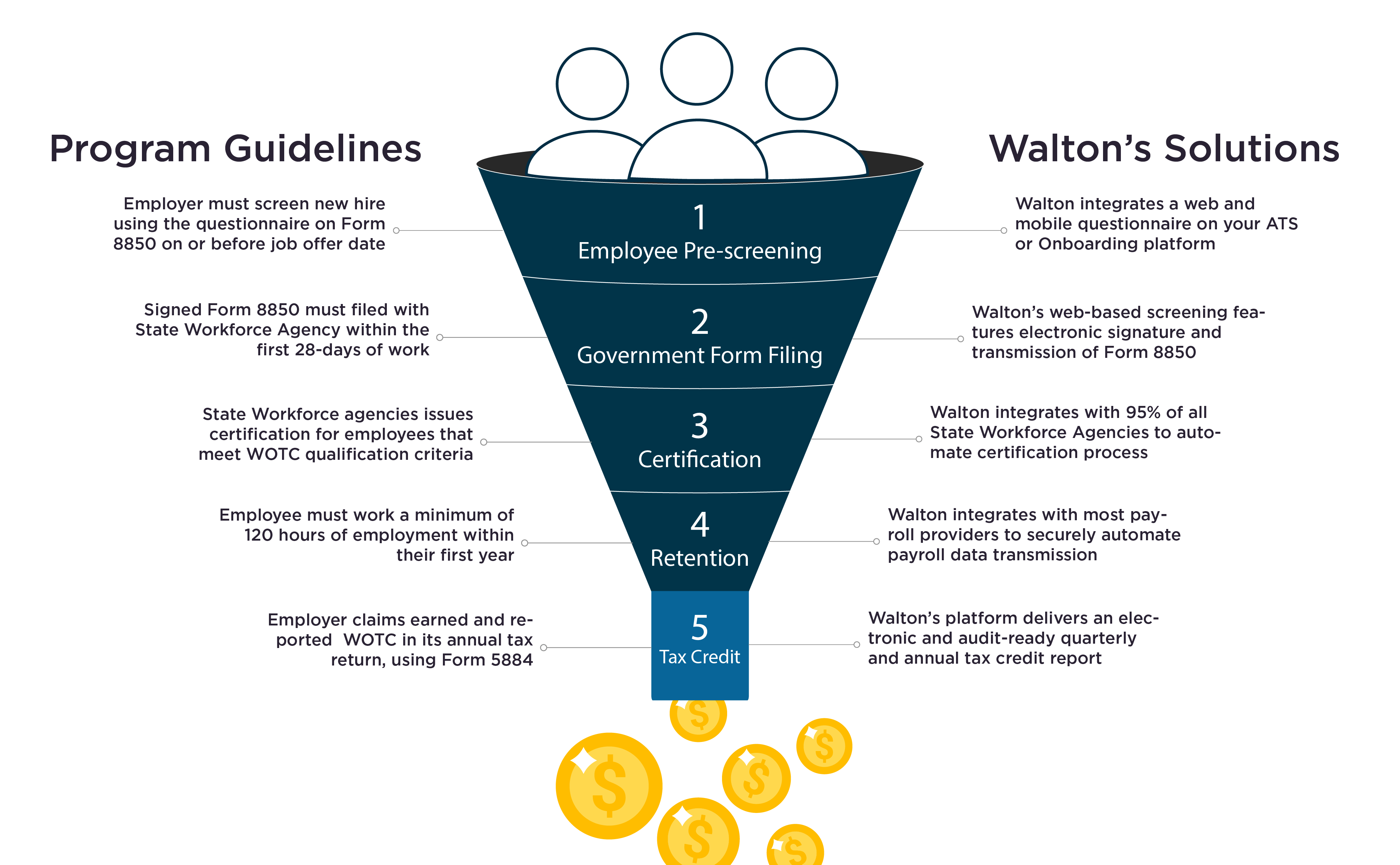

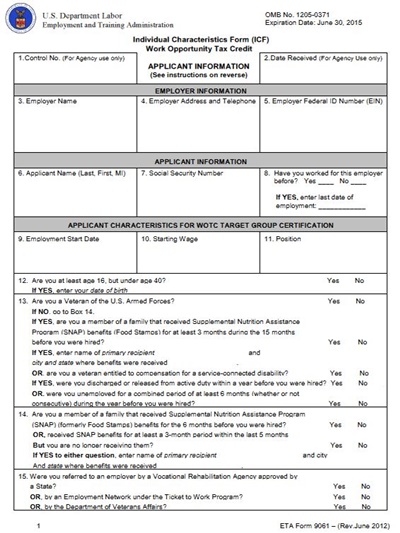

Employers must apply for and receive a certification verifying the new hire is a. This tax credit is dependent upon the new employee qualifying as a member of one of the below target groups and working a minimum of 120 hours in their first year. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals.

Hello WOTC is a tax credit that is available to employersYou might have seen the WOTC forms as part of an employment application or more likely part of the new hire paperwork if you were hired. Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. PdfFiller allows users to edit sign fill and share their all type of documents online.

The very first question is Are you under age 40 How is this legal. Is it legal for a companies to require that you fill out a tax credit screening in order to complete a job application. ADPs new mobile tax credit screening helps companies reduce the time and resources needed to determine.

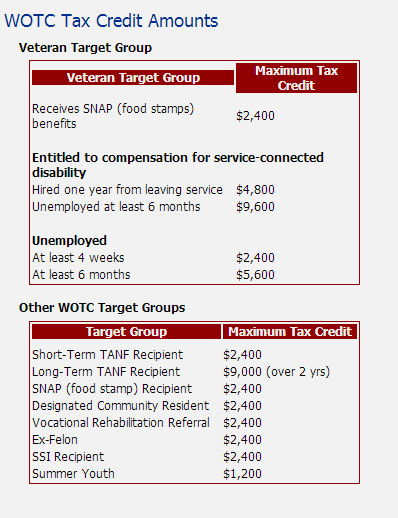

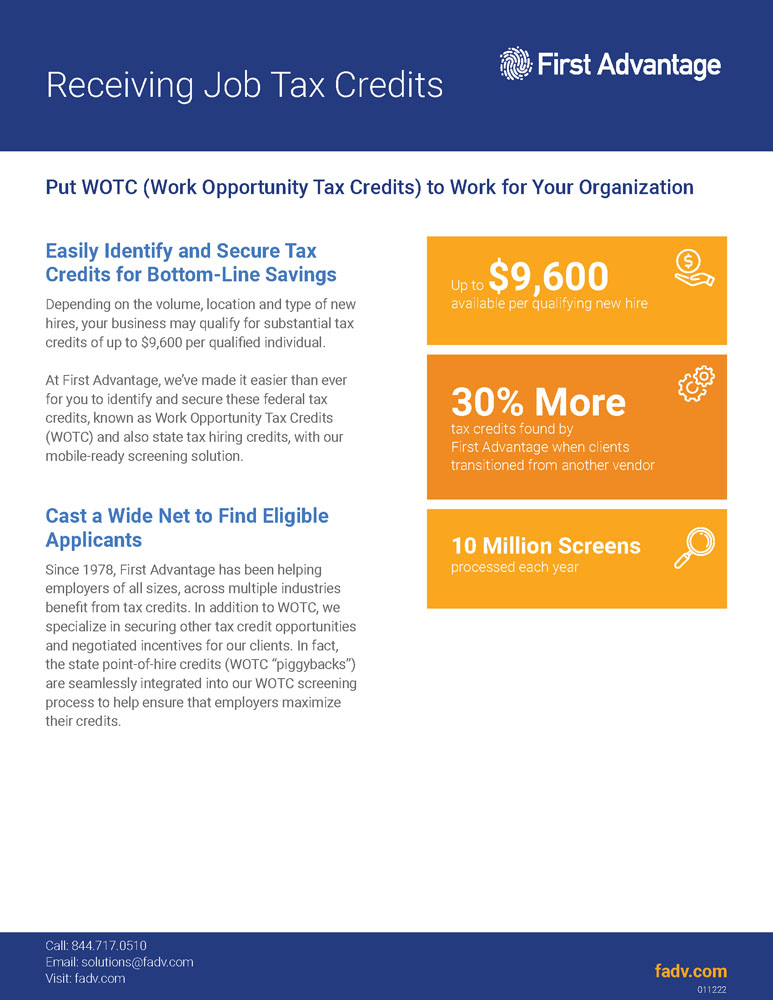

The Work Opportunity Tax Credit WOTC can help you get a job. How the Tax Credit Surveys are Used. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire eligible individuals from target groups with significant barriers to employment. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. WOTC is a Federal tax credit available to employers who hire and retain veterans andor individuals from other target groups with significant barriers to employment.

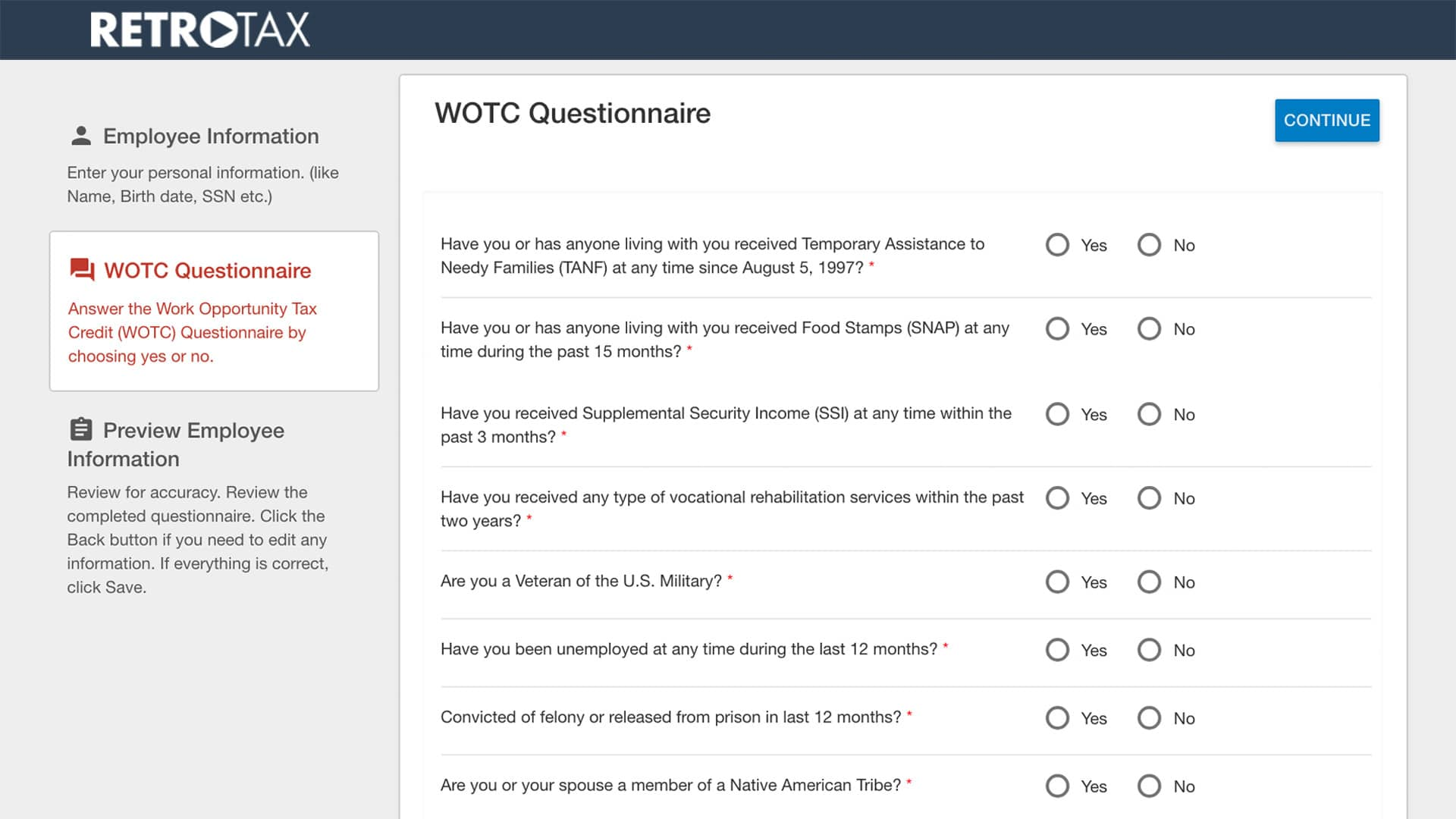

Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. The Missouri Work Opportunity Tax Credit WOTC Program offers an online application system for a more efficient means of submitting applications for certification.

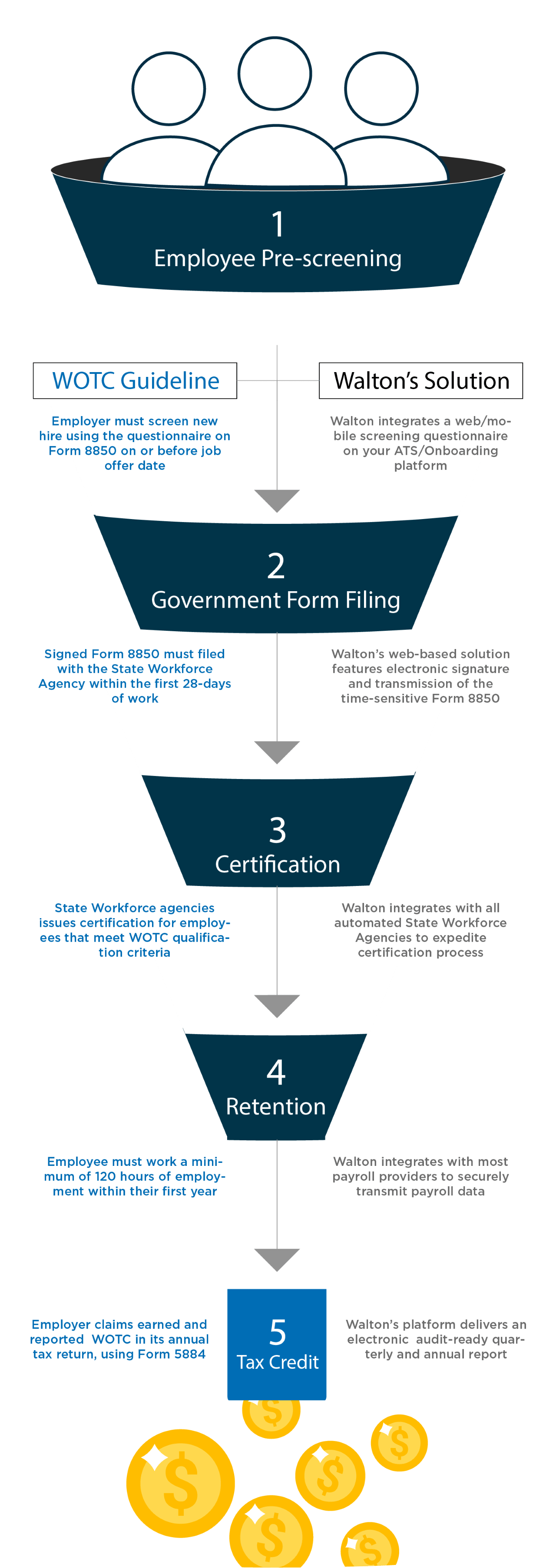

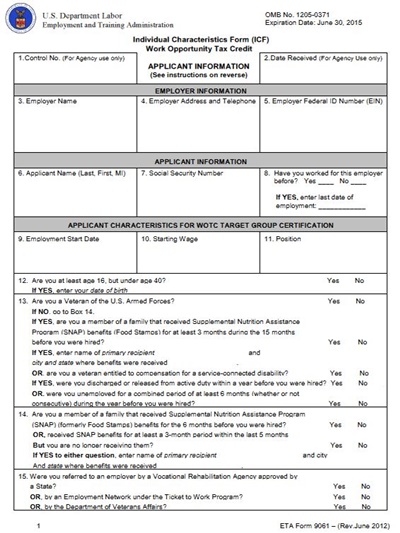

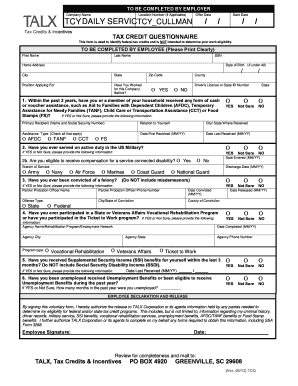

The application entry process includes entering employee and employer information from the completed and signed IRS Form 8850 and ETA Form 9061. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Updated on September 14 2021. The employee groups are those that have had significant barriers to employment. This tax credit may give the employer the incentive to hire you for the job.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Below you will find the steps to complete the WOTC both ways. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Thats why youll see job fairs targeting veterans or unemployed in IOWA or bumfuck nowhere Nebraska. There is no limit on the number of individuals an employer can hire to.

Completing Your WOTC Questionnaire. Is participating in the WOTC program offered by the government. This tax credit program has been extended until December 31 2025.

The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. About the WOTC Program.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. What is ADP tax credit screening. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

Employers claim about 1 billion in tax credits each year under the WOTC program. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process. Questions and answers about the Work Opportunity Tax Credit program. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

There are two sets of frequently asked questions for WOTC customers. A better way to search for jobs.

Retrotax Tax Credit Administration Jazzhr Marketplace

Adp Work Opportunity Tax Credit Wotc Integration For Icims By Adp Icims Marketplace

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

With Wotc Timing Is Everything Wotc Planet

Completing Your Wotc Questionnaire

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Work Opportunity Tax Credit What Is Wotc Adp

What Is Tax Credit Screening On Job Application

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts